Online Gambling Stocks

Should I invest in online gambling stocks? This question has been on many investors’ minds lately, but the answer varies depending on your investment goals and portfolio. Day traders might prefer the volatility of gambling stocks, while long-term investors will seek stable gains over time. The best online gambling stock picks are generally heavily weighted towards large-cap and mid-cap US stocks. There are many online trading platforms available, and the options and fees vary by provider. Some are better than others, and some even offer zero commissions. However, some of them are not available in all states.

Regardless of your investment strategy, online gambling stocks have a lot in common with stocks in other industries. Because the stock market and the gambling industry fluctuate, the risks are relatively low. Make sure to research your picks carefully before investing. In addition, it is best to talk to a tax professional to determine which tax brackets apply to online gambling stocks. Investing in gambling stocks is not for the faint of heart.

Penn National Gaming (PNKG) is another online gambling stock to watch. The company’s shares have climbed 25% year to date. Its operations span 41 facilities in 19 U.S. states, giving it the largest regional gaming footprint in the country. As it continues to expand into the online sector, Penn National Gaming has been a top choice among investors. Its expansion into the online gaming space has given it the opportunity to increase its business with a lower cost structure than traditional gaming establishments.

Should I Invest in Online Gambling Stocks?

Online gambling stocks have a high growth potential and offer relatively low risks to prospective investors. Online gambling is rapidly becoming a large industry with huge potential to become worth $90 billion by 2020. In addition to the growth in popularity, legalized online gambling in states like New Jersey has added a significant boost to the industry. The market for online gambling is set to continue growing exponentially as more states legalize the activity. In fact, this trend has even been exacerbated by the coronavirus pandemic.

There are many different ways to invest in online gambling, but the most popular choice for beginners is to invest in software companies or start your own casino. As with all investments, however, there are risks involved, so investing in a new business is not recommended for anyone without significant money. If you have a large amount of money, you can invest in the stocks of a company that is already well-known and has a solid reputation.

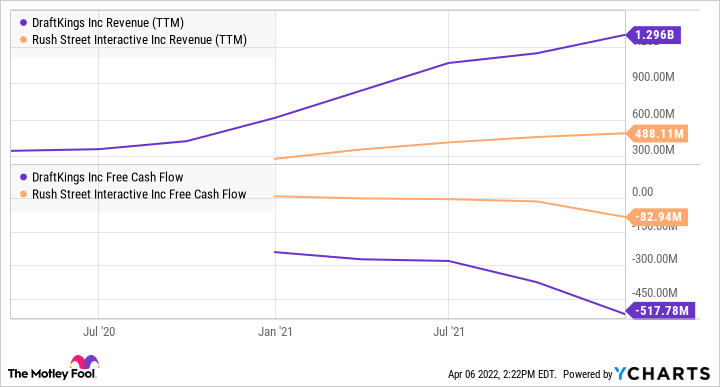

If you’re looking for a pure play in the industry, try one of the iGaming sector funds. The BETZ fund has a strong U.S. exposure, but is also well-diversified internationally. The top ten stocks in the portfolio are DraftKings (DKGS) and Rush Street Interactive (RSUW). You can also choose from Australian and British stocks. The key to investing in iGaming stocks is to find a good balance of diversified stocks.